Nifty Option Chain Demystified: A Beginner’s Handbook

For novice traders venturing into the dynamic world of options, the Nifty Option Chain can initially appear complex and intimidating. However, understanding its nuances is a crucial step toward harnessing the potential of options trading. This beginner’s handbook aims to demystify the Nifty Option Chain, offering a comprehensive guide for those taking their first steps in navigating this essential tool within the Indian stock market. Check on how to make demat account?

Introduction to Nifty Option Chain:

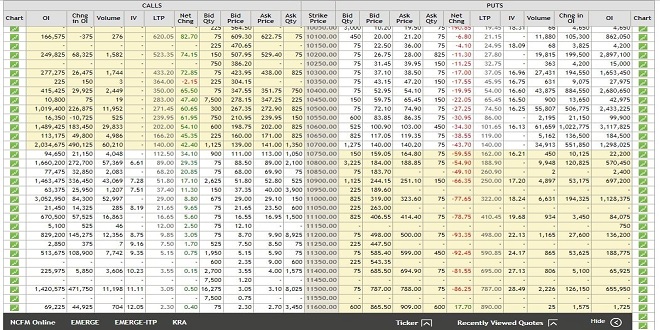

The Nifty Option Chain is a visual representation of the available call and put options for the Nifty index. Nifty, the benchmark index for the National Stock Exchange (NSE) in India, is a collection of stocks that reflects the overall market sentiment. The Option Chain provides a snapshot of various strike prices and expiration dates for both call and put options associated with the Nifty.

Key Components:

Strike Prices: The Option Chain lists a range of strike prices, representing the levels at which options can be exercised. These are organised from lower to higher levels, providing traders with choices based on their market outlook. Check on how to make demat account?

Expiry Dates: Options contracts have expiration dates, indicating the period during which the option can be exercised. The Option Chain displays multiple expiry dates, allowing traders to plan their strategies over different time horizons.

Call and Put Options: Call options give the holder the right to buy the underlying asset, while put options grant the right to sell. Traders can choose between these two types of options based on their market expectations.

Understanding Call and Put Options:

Call Options:

Buyer’s Perspective: A call buyer expects the price of the underlying asset (Nifty index) to rise. They pay a premium for the call option, gaining the right to buy Nifty at the specified strike price before or at the expiry date. Check on how to make demat account?

Seller’s Perspective: A call seller, or writer, anticipates that the Nifty index will not surpass the strike price. They receive the premium from the buyer and may be obligated to sell Nifty if the buyer chooses to exercise the option.

Put Options:

Buyer’s Perspective: A put buyer anticipates a decline in the Nifty index. They pay a premium for the put option, gaining the right to sell Nifty at the specified strike price before or at the expiry date.

Seller’s Perspective: A put seller believes that the Nifty index will not fall below the strike price. They receive the premium from the buyer and may be obligated to buy Nifty if the buyer exercises the option.

Open Interest (OI):

Open Interest is a critical metric within the Nifty Option Chain. It represents the total number of outstanding options contracts for a specific strike price and expiry date. Higher OI indicates increased market interest and liquidity for a particular option, offering insights into trader sentiment. Check on how to make demat account?

Navigating the Option Chain:

Choosing Strike Prices: Novice traders often start with at-the-money (ATM) or slightly out-of-the-money (OTM) options. ATM options have strike prices close to the current Nifty index level, while OTM options have slightly lower strike prices.